7

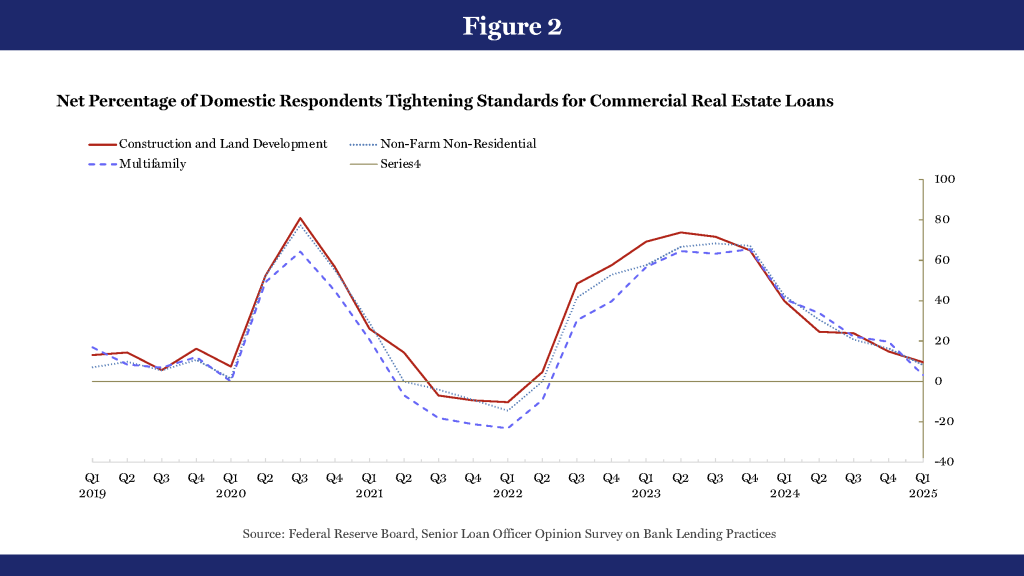

There is more evidence that US banks are now over the worst of the commercial real estate (CRE) crisis, with the net share of domestic banks that have tightened their standards for commercial real estate loans declining markedly in recent months. Banks are also now reporting more positive demand trends for CRE loans, further underscoring the brighter prospects for a sector badly damaged by rising interest rates in recent years.

According to the January edition of the quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices, only “a modest net share” of banks reported having tightened standards for construction and land-development loans as well as loans secured by nonfarm, non-residential properties, while standards for loans secured by multifamily properties remained “basically unchanged on net”.

On the demand side, again, only “a modest net share” of banks reported weaker demand for construction and land-development loans, while it was basically unchanged for other types of CRE loans. What’s more, a modest net share of large banks reported “stronger demand” for loans secured by nonfarm, non-residential and multifamily properties, while it was “basically unchanged” for construction and land-development loans at large banks. The survey also reported that a “significant net share” of foreign banks reported stronger demand for CRE loans.

With President Donald Trump now back in office, improving investor sentiment is prompting US regional banks to raise billions of dollars in equity to pursue deals and strengthen their balance sheets. Since Trump’s election victory in November, banks have raised $1.7 billion through share sales, according to data from financial-data analytics firm LSEG (London Stock Exchange Group), almost equal to the $1.8 billion raised between January and October 2024.

But with investor optimism surging over the likelihood of an easing of the regulatory rules surrounding mergers and acquisitions (M&A) under a Trump administration, banks’ equity volumes have soared in recent months, with the likes of acquisitions by Fulton Financial, UMB Financial and Old National Bank examples of deals being supported by new capital.

“Share prices improved due to the perception of improved growth and an expectation of a more friendly regulatory environment,” according to John Esposito, Morgan Stanley’s global co-head of financial institutions. “Most banks desire to get bigger, and there may be changes in the regulatory approval process and the proposed capital rules,” Esposito told Reuters on February 7, adding that he expected M&A activity to be concentrated among mid-sized lenders, particularly those with less than $50 billion in assets.

On January 17, four of Canada’s biggest banks—Bank of Montreal (BMO), National Bank of Canada, TD Bank Group and Canadian Imperial Bank of Commerce (CIBC)—confirmed their exits from the United Nations-backed Net-Zero Banking Alliance (NZBA), which aims to accelerate climate action among financial institutions. The withdrawals from the coalition followed departures by the United States’ six largest banks since December in anticipation of the pro-fossil-fuel agenda of new US President Donald Trump.

Indeed, North American banks have been heading for the exits following repeated attacks by US Republican politicians regarding various climate-change initiatives, particularly the integration of ESG (environmental, social and governance) considerations into business operations. Despite their departures from the NZBA, the banks insist that their climate work will continue. BMO spokesperson Jeff Roman, for instance, said the bank is fully committed to its climate strategy and supporting its clients in their transitions to net zero. “We have robust internal capabilities to implement relevant international standards, supporting our climate strategy and meeting regulatory requirements.”

The likely designation of Mexican cartels as terrorist organisations is putting the Mexican banking industry on edge over fears they could face severe penalties for unknowingly supporting criminal activity. According to officials who spoke to Bloomberg, Mexico’s banking industry will take a more conservative approach to lending and other services, given its role as an intermediary in transactions. Mexican banking is dominated by a handful of foreign firms that could curtail business in areas that may have connections to the drug trade, such as mining, livestock, transportation and agriculture.

The Mexican banking system has a loan portfolio of 7.5 trillion Mexican pesos (US$363 billion) and moves around 14 million interbank transfers per day. Law-enforcement officials have said that only a small fraction of that amount is directly linked to drug traffickers, but it is more difficult to calculate protection fees, ransoms or other under-the-table dealings being paid by individuals and businesses.

“This is a challenge to the financial system like it has never seen,” Sandro Garcia, a former top money-laundering official at Mexico’s banking regulator and independent consultant, explained to Bloomberg. “This is going to be ‘know your customer’ times 10.” Some financial institutions provide correspondent-banking services and enable transactions, including processing funds, trade finance and cash management between two parties, which makes screening for illicit activity a challenging endeavour. Trump’s “foreign terrorist organization” designation could cripple such businesses and force banks to rewire their risk models, Garcia added.

Although the Bank of Jamaica (BoJ) has been reducing interest rates of late, businesses and households are not benefiting, as commercial banks are refusing to adjust their interest rates downwards accordingly. The BoJ cut its monetary policy rate by 25 basis points to 6 percent in December 2024, continuing its easing cycle that began in August 2024. But commercial-banking rates are still reportedly averaging 10 percent, a modest decline from last year’s 11.5-percent peak.

The BoJ’s governor, Richard Byles, suggested fixing the problem through legal routes. “There are things that can be done in law that could help, and that is something that we’re contemplating, and that could be more short term,” Byles told the Parliament’s Economy and Production Committee on January 21. The minister of Industry, Investment and Commerce, Senator Aubyn Hill, meanwhile, has pressed banks to reduce their own rates in response to the BoJ’s rate reductions. “We need to make sure the banks understand that, and people need to see that. Economic growth is what we have to do, after we put our fiscal house in order,” Senator Hill said on January 29.

Led by digital banks, Brazilian banks’ profitability improved during the first half of 2024, according to the Banco Central do Brasil’s (BCB’s) “Financial Stability Report” (FSR), published on November 21. The report also noted that the annual return on equity (ROE) for the Brazilian banking system rose to 15.11 percent by June 30, up from 14.23 percent at the end of December 2023. Net interest income (NII) and service revenues are also expected to have registered growth during the second half of the year, the central bank added.

Digital banks were a key driver of this growth, with their combined ROE rising to 19.1 percent by the end of June—the highest among segments—from 11.45 percent at the end of December. The likes of Nubank, Banco Inter and C6 Bank were among the top picks of the digital lenders, with the central bank attributing the sharp increase to “positive effects of operational leverage through the monetization of customer bases by some institutions and lower pressure from provisioning expenses”.

The central bank’s director of supervision, Ailton de Aquino, said digital banks have a “robust” credit model, attributing their lower provisioning levels compared with public and private banks to the sector’s level of maturity, as reported by Reuters. Ailton de Aquino also credited the evolution of digital institutions in Brazil to the central bank’s efforts to promote innovation and competition. “The outlook for profitability in the coming periods is for continued gradual improvement, supported by revenue growth, relatively stable provisioning costs, and controlled operating expenses,” the “Financial Stability Report” also noted.

Early January saw Argentina unveil a $1-billion repurchase agreement (repo) with five international banks that will do much to replenish the foreign reserves held at the central bank. As such, the move represents a major triumph for President Javier Milei, who continues to seek stability for the beleaguered economy. The repo deal will remain in place for two years and four months, the monetary authority stated, with Citigroup reportedly among the participants. The central bank also confirmed it had received offers for $2.85 billion and that it would pay the secured overnight financing rate (SOFR) plus a spread of 4.75 percent on the repo line.

According to unnamed sources who spoke to Bloomberg, the four other lenders were JPMorgan Chase, Banco Bilbao Vizcaya Argentaria (BBVA), Banco Santander and Industrial and Commercial Bank of China (ICBC). The banks’ press offices have not commented on the deal. Nonetheless, reports of the transaction have helped boost Argentina’s sovereign bonds. “The stars are aligning for Argentina,” Aaron Gifford, an emerging markets sovereign analyst at T. Rowe Price in Baltimore, told Bloomberg. “While there’s already been a significant rally, I think there’s probably a bit more room to go.”

The repo agreement has been developed in tandem with Buenos Aires’s negotiations with the International Monetary Fund (IMF) for a new programme to succeed the country’s $44-billion deal. Milei and Minister of Economy Luis Caputo have said that a deal could be finalised within the first four months of this year and that it may include new funds that go beyond the previous programme’s financing. According to Gifford, this all amounts to sustained tailwinds for Milei. “They’re essentially back to market access; they’ve already secured the funds to pay down near-term maturities, and a new IMF program is in the making.”

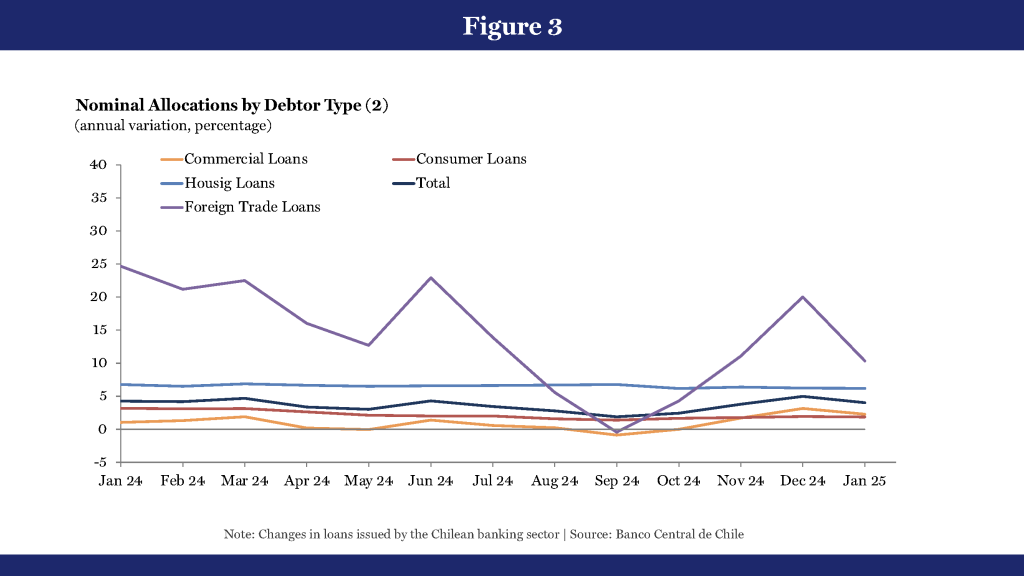

In January, Chile’s interest rates on foreign trade, commercial loans and consumer loans increased considerably to 6.0 percent, 9.0 percent and 24.5 percent, respectively, from December’s levels of 5.9 percent, 8.7 percent and 23.2 percent. Rates on housing loans remained the same at 4.4 percent. The central bank attributed the higher rate on consumer loans to increases in the rates for credit cards and overdrafts. In the case of commercial loans, rates were increased for all sections, while the rate for foreign trade increased for both exports and imports.

In January, the total loans granted by banks experienced annual growth of 4 percent, lower than December’s 5 percent due to “the lower dynamism of commercial and foreign trade loans”, which showed variations of 2.3 percent and 10.3 percent (December: 3.1 percent and 20.0 percent), respectively. The appreciation of the peso against the dollar also contributed to the lower growth rates of commercial and foreign-trade loans, the central bank added. Consumer and housing loans, meanwhile, grew by 1.9 and 6.2 percent, respectively.

“I have decided, in accordance with my constitutional powers, to appoint economists Laura Moisa and César Giraldo to the board of directors of the Bank of the Republic [Banrep],” Gustavo Petro posted on X on January 16. In so doing, the Colombian president has appointed two academics to the central bank, which could significantly tilt the balance of monetary power in favour of more dovishness as far as interest-rate cutting is concerned.

The board has been divided in recent months between those in favour of faster interest-rate cuts to stimulate economic growth and those who prefer more moderate reductions to ensure inflation continues to slow toward its target. At the bank’s December meeting, five of the seven policymakers voted to slow the pace of easing versus two who wanted deeper cuts. As such, the new appointments could tip the balance in favour of faster easing, depending on which board members the pair replace.

Moisa is an economics professor and deputy rector of the National University of Colombia in Medellin, while Giraldo is a Paris-educated economist who serves on the committee charged with overseeing Colombia’s fiscal rules, or budget-balancing act. “The two members seem in line with policies aimed at reducing interest rates at a faster pace,” said Sergio Olarte, chief economist at Panama-based Banco Latinoamericano de Comercio Exterior (Bladex). “One might expect the tone of Banrep to lean more toward the dovish side.”

>>>NORTH AMERICA AWARD WINNERS

BANKING CEO OF THE YEAR

North America

Mr. Jamie Dimon

JPMorgan Chase & Co (United States)

**********

BEST CUSTOMER SERVICE

PROVIDER OF THE YEAR

North America

Frost Bank (United States)

**********

Best Investment Bank Of The Year Canada

RBC Capital Markets

Best Investment Bank Of The Year Mexico

Alfaro, Dávila & Scherer (ADS)

Best Investment Bank Of The Year United States

JPMorgan Chase & Co.

Best Commercial Bank Of The Year Canada

TD Bank

Best Commercial Bank Of The Year Costa Rica

BAC

Best Commercial Bank Of The Year Guatemala

Banco Industrial

Best Commercial Bank Of The Year Mexico

BBVA México

Best Commercial Bank Of The Year Panama

Banco General

Best Commercial Bank Of The Year United States

Wells Fargo

Best Private Bank Of The Year Canada

RBC Wealth Management

Best Private Bank Of The Year Mexico

Santander Private Banking

Best Private Bank Of The Year United States

Bank of America

Best Innovation In Retail Banking Grenada

Grenada Co-operative Bank

Best Innovation In Retail Banking Jamaica

National Commercial Bank Jamaica (NCBJ)

Best Innovation In Retail Banking Mexico

BBVA Mexico

Best Innovation In Retail Banking Panama

Banco General

Best Neobank Of The Year Canada

Neo Financial

Best Neobank Of The Year Mexico

Albo

Best Neobank Of The Year United States

SoFi

Best Mortgage Lender Canada

RBC Royal Bank

Best Mortgage Lender United States

Bank of America

Cross-Border Payment Company Of The Year North America

Bottomline Technologies Inc.

Sustainable Bank Of The Year Canada

Bank of Montreal (BMO)

Sustainable Bank Of The Year United States

Bank of America

>>>SOUTH AMERICA AWARD WINNERS

BANKING CEO OF THE YEAR

South America

Mr. Roberto González Müller

Banco del Pacífico (Ecuador)

**********

BEST CUSTOMER SERVICE

PROVIDER OF THE YEAR

South America

Banco de Crédito del Perú (BCP)

**********

Best Commercial Bank Of The Year Argentina

Banco Nación (BNA)

Best Commercial Bank Of The Year Bolivia

Banco Mercantil Santa Cruz

Best Commercial Bank Of The Year Chile

Banco Santander Chile

Best Commercial Bank Of The Year Colombia

Bancolombia

Best Commercial Bank Of The Year Peru

Interbank

Best Commercial Bank Of The Year Uruguay

Banco República (BROU)

Best Private Bank Of The Year Brazil

Itaú Private Banking

Best Private Bank Of The Year Chile

LarrainVial

Best Innovation In Retail Banking Argentina

Banco Provincia

Best Innovation In Retail Banking Brazil

Banco BRB

Best Innovation In Retail Banking Chile

Banco de Chile

Best Innovation In Retail Banking Colombia

Banco Davivienda

Best Innovation In Retail Banking Guyana

Demerara Bank

Best Innovation In Retail Banking Paraguay

Banco Itaú

Best Innovation In Retail Banking Peru

Banco de Crédito del Perú (BCP)

Best Innovation In Retail Banking Uruguay

Banco República (BROU)

Best Neobank Of The Year Brazil

Nubank (Nu)

Best Mortgage Lender Brazil

Banco BRB

Best Mortgage Lender Guyana

Demerara Bank

Best Mortgage Lender Colombia

Bancolombia

Cross-Border Payment Company Of The Year South America

Bamboo Payment Systems

Sustainable Bank Of The Year Chile

BancoEstado

Sustainable Bank Of The Year Ecuador

Banco del Pacífico

Sustainable Bank Of The Year Peru

Interbank

Author :

Publish date : 2025-02-23 17:00:00

Copyright for syndicated content belongs to the linked Source.

—-

Author : theamericannews

Publish date : 2025-02-24 10:13:19

Copyright for syndicated content belongs to the linked Source.