In the wake of sweeping sanctions imposed on Russia due to its actions in Ukraine, Asian countries are swiftly recalibrating their energy strategies to secure crude oil supplies. As traditional avenues of procurement become constrained, nations across the region are escalating efforts to fill the void left by Russian oil exports, which have been significantly impacted by global restrictions. This article delves into the intricate dynamics of the Asian oil market, exploring how countries like China and India are maneuvering to source alternative crude supplies, the implications for global oil prices, and the broader geopolitical ramifications of this pivot in energy sourcing. As the landscape of global energy continues to evolve, Asia’s proactive approach may not only redefine its relationship with energy security but also influence the future trajectory of the international oil market.

Asias Strategic Pivot: The Quest for Alternative Oil Sources

As countries in Asia grapple with the fallout of the sanctions imposed on Russian crude oil, a palpable shift in strategy is unfolding across the continent. Major economies are actively seeking alternative oil sources to diversify their energy dependencies and minimize potential disruptions. Key players such as India and China are leading the charge, negotiating deals with oil-rich nations in the Middle East and Africa to secure their energy needs. The urgency is underscored by rising global oil prices and the need for stability in supply chains, compelling these nations to swiftly adapt their purchasing strategies.

In this landscape, new alliances are forming, characterized by unprecedented engagement in long-term contracts. Countries are exploring various options, including:

Expanding imports from Saudi Arabia and the UAE

Increasing purchases from West African producers

Developing renewable energy partnerships

The pivot towards alternative sources is reflected in the following data table:

Country

New Oil Source

Contract Duration

India

Saudi Arabia

5 years

China

Nigeria

3 years

Japan

UAE

4 years

This strategic pivot not only enhances energy security but also positions Asia as a pivotal player in the global oil market amidst shifting geopolitical landscapes.

Market Dynamics: How Asian Nations Are Adapting to Supply Shortages

As the geopolitical landscape shifts, Asian nations are rapidly recalibrating their energy strategies in response to the sanctions imposed on Russian crude oil. Countries like India, China, and several Southeast Asian nations are strengthening their energy security by diversifying their crude oil sources. This shift is characterized by increased imports from countries in the Middle East, Africa, and even the Americas, allowing these nations to fill the gap left by restricted access to Russian oil. The growing demand in Asian markets for alternative suppliers has led to intensified negotiations and long-term contracts, fostering stronger bilateral relationships with traditional and emerging oil-exporting nations.

To effectively manage these supply shortages, nations are also investing heavily in local refining capabilities and fostering innovation in energy technologies. Initiatives include:

Building new refineries to process different grades of crude oil.

Enhancing logistics systems to improve oil transport efficiency.

Pursuing renewable energy projects to reduce dependency on fossil fuels in the long run.

Furthermore, some countries are exploring strategic reserves that can be tapped in times of crisis, ensuring that energy needs remain stable amid global volatility. Asian nations are demonstrating a proactive approach, not just to survive supply disruptions, but to emerge more resilient in the face of changing global energy dynamics.

The Role of Middle Eastern Producers in Filling the Gap

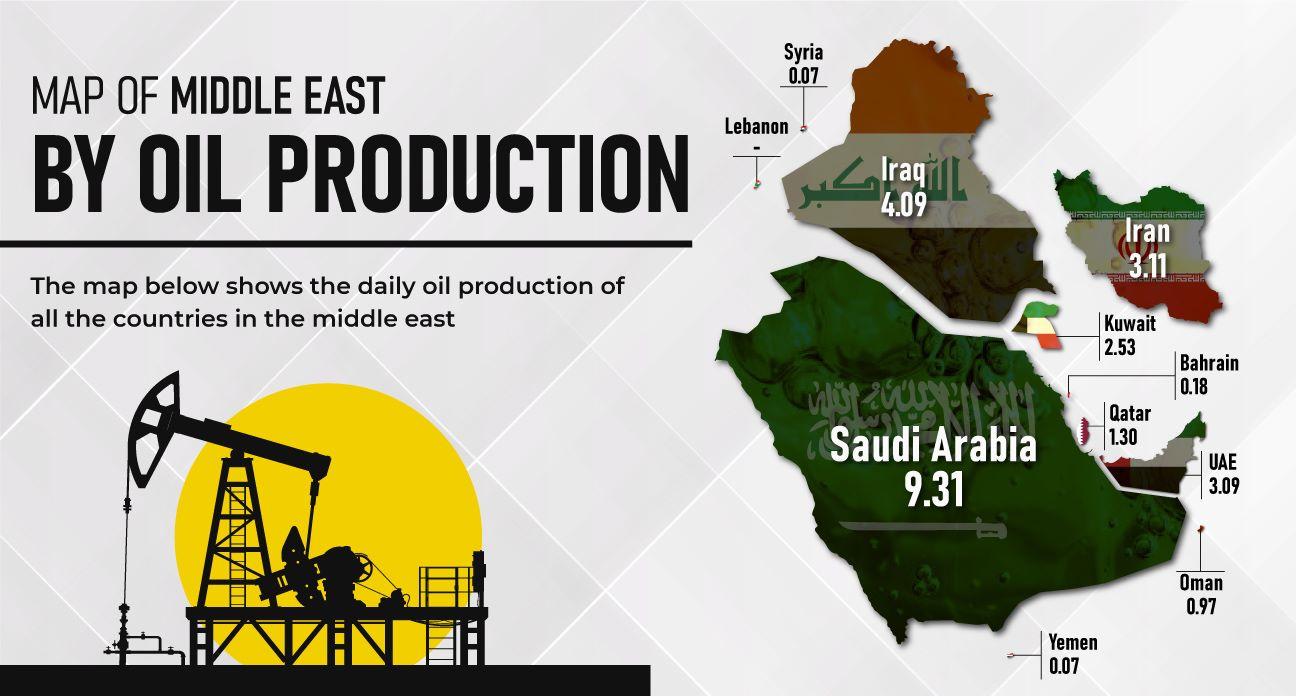

The global energy landscape has experienced a significant transformation, particularly following the sanctions imposed on Russian crude oil. Middle Eastern producers, with their extensive oil reserves and established infrastructure, are ideally positioned to step into this void. Countries such as Saudi Arabia, Iraq, and the United Arab Emirates have the capacity to increase their output and maintain supply stability for Asian markets. Given their proximity and logistics advantages, these nations are not just filling a gap; they are becoming pivotal players in a restructured energy economy where demand continues to surge.

To understand the dynamics at play, it is crucial to consider the economic implications of this shift. Middle Eastern nations can leverage their oil wealth to enhance trade relationships across Asia, with countries like China and India eager to diversify their energy sources. The benefits extend beyond mere oil supply, facilitating broader economic cooperation and investment opportunities. Key contributors from the region include:

Saudi Arabia: Maintaining its status as a leading oil exporter, capable of increasing output rapidly.

Iraq: Possessing the capacity to expand production and repair existing infrastructure.

UAE: Enhancing strategic partnerships through its diversified energy portfolio.

This evolving scene also necessitates a nuanced understanding of pricing trends, export patterns, and the geopolitical influences that shape these markets. The interplay between supply and demand will likely dictate future relationships, making it essential for stakeholders to remain informed about the changing tides in crude oil sourcing.

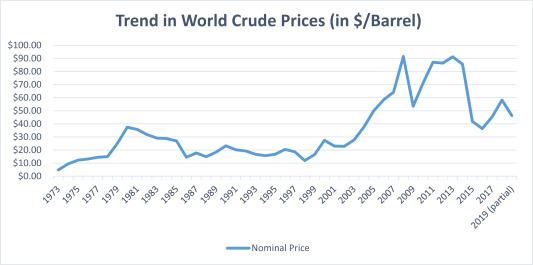

Long-Term Implications for Global Oil Prices and Supply Chains

The shifting dynamics in global oil markets are poised to have profound and lasting effects on both prices and supply chains. As Asian nations proactively seek alternatives to sanctioned Russian crude oil, they are likely to influence demand and pricing structures across the industry. Key factors that may shape these developments include:

Increased competition for alternative oil sources, potentially driving up prices.

Investment in infrastructure to facilitate the import of non-Russian oil.

Changes in trade relationships, particularly between Asian countries and oil-producing nations in the Middle East and Africa.

Furthermore, the realignment of supply chains is expected to introduce volatility into the market, complicating logistics and increasing transportation costs. Countries looking to replace Russian oil may experience initial disruptions as they adjust their supply chains, but the long-term implications could yield greater stability through diversified sources. A quick glance at potential future scenarios reveals:

Scenario

Potential Impact

Increased Asian Imports from the Middle East

Higher overall demand may raise global oil prices.

Emerging Markets Expanding Oil Production

Potential stabilization of prices as new sources come online.

Development of Renewable Energy Alternatives

Long-term pressure on traditional oil markets could lower prices.

Sustainability Considerations: Balancing Energy Needs and Environmental Impact

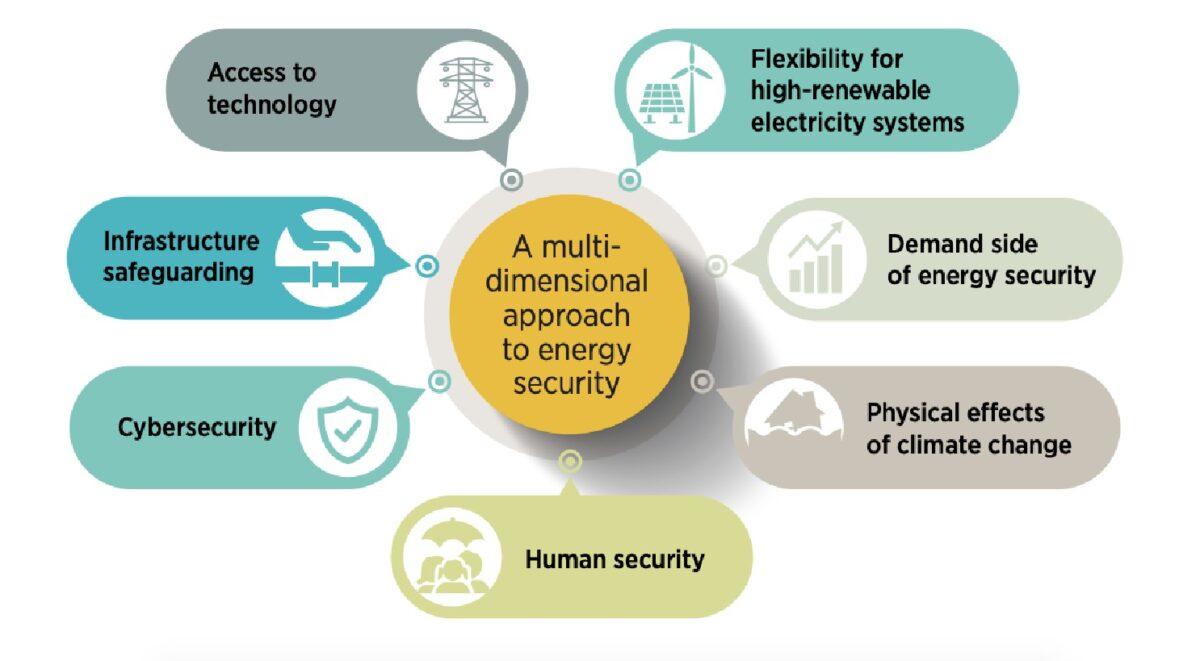

As countries in Asia pivot towards alternative sources of energy, the urgency of minimizing environmental impact becomes paramount. Nations are grappling with the dual challenge of securing reliable energy supplies while committing to sustainable practices. This scenario has led to increased investments in renewable energy technologies, alongside a focus on improving energy efficiency. Options such as solar, wind, and hydropower are not merely supplementary but are becoming central pillars of energy infrastructure.

While transitioning from sanctioned Russian crude oil, the region faces an opportunity to reevaluate its energy landscape. Implementing stringent regulatory frameworks ensuring environmental sustainability must accompany this shift. Key considerations include:

Carbon emissions: Stricter emissions standards for new energy projects.

Resource management: Responsible sourcing of raw materials for renewable technologies.

Waste reduction: Innovations in disposal and recycling of energy-related waste.

Ultimately, balancing energy needs with environmental stewardship will define the future of Asia’s energy policies, ensuring that progress does not come at the expense of the planet.

Recommendations for Investing in Energy Security and Diversification Strategies

As geopolitical tensions shape the global energy landscape, investing in sustainable energy security remains an imperative for nations heavily reliant on imports. Diverse supply chains and robust alternatives to sanctioned sources are vital. Governments and private sectors should consider investing in technologies and infrastructures that facilitate energy independence. This includes exploring options such as:

Renewable Energy Investments: Solar, wind, and hydroelectric projects can cushion reliance on fossil fuels.

Energy Storage Solutions: Developing advanced battery technologies enhances capacity to manage renewable output.

Strategic Oil Reserves: Building and maintaining reserves can provide a buffer during supply disruptions.

Furthermore, fostering international collaborations will be crucial for accessing alternative markets and sharing technological innovations. Some key areas for collaboration and investment could include:

Joint Ventures in Exploration: Partnering with countries rich in untapped resources can diversify supply sources.

Research and Development Initiatives: Shared investment in energy technologies can accelerate breakthroughs in efficiency and sustainability.

Infrastructure Upgrades: Enhancing pipelines and shipping routes ensures smoother transitions between suppliers.

Investment Area

Potential Benefits

Renewable Energy

Reduces carbon footprint and increases sustainability

Energy Storage

Improves reliability and efficiency of renewable resources

Infrastructure

Facilitates diversification and security of supply chains

The Way Forward

as Asia rapidly pivots to fill the void left by sanctioned Russian crude oil, the region’s markets are witnessing significant shifts in supply chains and trade dynamics. With countries like India and China stepping in to absorb the surplus of Russian oil at discounted prices, the geopolitical landscape of energy distribution is evolving. This strategic maneuvering not only underscores Asia’s growing influence in the global oil market but also raises questions about the long-term implications for energy security and international relations. As the situation develops, stakeholders across the energy sector will need to closely monitor these changes, navigating the complexities of evolving partnerships and the impact of policy decisions on future oil supply and demand.

The post Asia moves quickly to replace sanctioned Russian crude oil – Reuters first appeared on Asia News.

—-

Author : Asia-News

Publish date : 2025-02-13 20:32:26

Copyright for syndicated content belongs to the linked Source.