On Tuesday, a significant shift in North American trade dynamics will come into effect as tariffs imposed by the Trump governance on imports from Canada and Mexico begin to impact the marketplace. The move, initially aimed at addressing trade imbalances and protecting domestic industries, has raised concerns about rising prices for a variety of goods across the United States. As consumers prepare to face potentially higher costs for everything from agricultural products to everyday consumer goods, experts are closely examining which sectors might be hit hardest. In this article, we will explore the implications of these tariffs, identify the products likely to see price increases, and assess how this policy shift could reshape trade relationships within North America.

Impact of Tariffs on Canadian and Mexican Imports and U.S. Consumers

The implementation of tariffs has begun to reshape the economic landscape for imports from Canada and Mexico, significantly affecting U.S.consumers. As businesses adjust to the increased costs, several key product categories are poised for noticeable price hikes, leading to shifts in purchasing behavior. industry experts highlight that consumers may see escalation in prices for:

Automobiles: Cars and auto parts imported from Canada and Mexico are expected to rise, reflecting higher costs that manufacturers will pass on to buyers.

Agricultural Products: Items such as produce and dairy from these countries may also experience uplift in retail prices, as tariffs challenge competitive pricing.

consumer Goods: Everyday goods ranging from electronics to furniture could be affected, as companies factor in tariffs into their pricing models.

Moreover,the tariffs could lead to broader economic implications,including changes in retailer inventory management and potential shifts toward domestic sourcing. Businesses may seek alternatives to mitigate the impact of tariffs through:

Re-evaluating Supply Chains: Companies may reconsider their supply chain strategies, potentially sourcing materials from other countries less impacted by tariffs.

Innovative Pricing Solutions: Retailers might introduce promotions or discounts on other items to offset rising prices on tariffed imports, aiming to retain consumer loyalty.

Investment in local Production: Some businesses might invest more in local manufacturing to bypass the tariffs entirely, reshaping the production landscape.

Sector-Specific Price Increases: What to Expect at the Checkout

As tariffs imposed by the Trump administration take effect on imports from Canada and Mexico, consumers should brace themselves for noticeable changes at the checkout. Various sectors will experience price increases due to elevated costs associated with imported goods, impacting everything from daily groceries to long-term investments. Key areas likely to see price hikes include:

Automotive Parts: Increased tariffs will likely lead to higher prices for car repairs and new vehicles.

construction Materials: Products such as lumber and steel may see surges in prices, further driving up home-building costs.

Agricultural Goods: Expect increased prices on food items where imported ingredients play a significant role.

Consumer Electronics: Electronics that utilize components sourced from these nations may experience a cost rise.

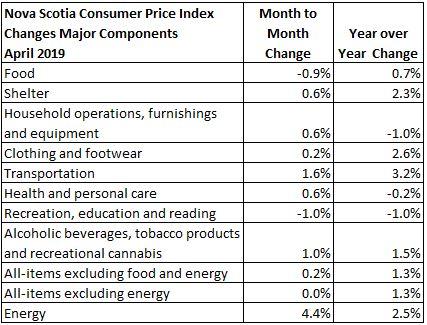

To better understand how these tariffs will affect specific industries, consider the following table showcasing projected price increases in select categories:

Sector

Current Average Price

Projected Increase

Automotive Parts

$300

+15%

Lumber

$450

+20%

Groceries

$150 (monthly)

+10%

Electronics

$800

+5%

These increased costs will not only affect consumers directly at the point of purchase but may also alter the competitive landscape in various industries.As businesses adapt to these tariffs, shoppers may need to reconsider their spending habits and seek alternatives to manage the expected price hikes effectively.

Analyzing the Broader Economic Implications of U.S. Tariffs

The imposition of tariffs by the U.S. on trade partners such as Canada and Mexico can bring about a complex web of economic consequences that reverberate throughout various sectors. Consumers will likely face increased prices on everyday goods as manufacturers and retailers pass on the higher costs incurred from tariffs. Construction materials,automobiles,and agricultural products are just a few examples where markups can be expected. Specifically,sectors like automotive and agriculture could see significant disruptions,affecting not only pricing but also supply chain dynamics and employment levels within these industries.

Moreover,these tariffs can lead to retaliatory actions from neighboring countries,further escalating tensions in trade relations. Such actions can initiate a cycle of exchanges that may prioritize national interests but could ultimately hurt U.S. economic growth. In the long run, this situation may compel businesses to explore alternatives, such as sourcing materials from non-tariff countries, which could lead to shifts in customary trade alignments and impact job availability. Key factors to monitor include:

Consumer inflation rate

Import/export volumes

Job creation or loss in key sectors

Responses from trade partners

Strategies for Consumers to Mitigate Rising Costs Amid Tariff Increases

As consumers brace for the impact of tariff increases on goods imported from Canada and Mexico, there are several proactive measures thay can take to minimize their expenses. One effective strategy is to prioritize local purchases. By buying products made closer to home, consumers can often avoid the inflated prices driven by tariffs on imported goods. supporting local businesses not only helps the economy but also reduces transportation costs,which can provide better value for shoppers.Additionally, keeping an eye on seasonal sales and promotions can help consumers snag better deals on necessary items, allowing them to fill their shopping carts without breaking the bank.

Another avenue to explore is budgeting and financial planning.Consumers should regularly review their spending habits and adjust their budgets to account for rising prices. Establishing a clear budget allows for better tracking of discretionary spending, helping to identify areas where cuts can be made. Moreover, consumers can enhance their purchasing power by utilizing loyalty programs and coupons offered by retailers. Many stores provide discounts for members or through app-based incentives, which can lead to significant savings over time. Here’s a swift look at potential financial adjustments:

Adjustment

Benefit

Prioritize local products

Avoid tariff-induced price hikes

Set a strict budget

enhance spending awareness

Use coupons and loyalty programs

Access discounts and savings

Future Outlook

As the clock ticks down to the implementation of President trump’s tariffs on imports from Canada and mexico, consumers and businesses alike brace for the effects of this trade policy shift. With various sectors poised to experience price hikes, from automotive to agriculture, the repercussions of these tariffs will resonate throughout the economy in the coming months. As stakeholders adapt to this new landscape, it is indeed essential to remain informed about the potential changes in pricing and availability of goods. In a global economy, the interplay between trade policy and market dynamics continues to shape the daily lives of millions. As we move forward, monitoring these developments will be crucial in understanding not only the immediate impacts but also the broader implications for U.S. relations with its neighbors and the overall health of the North American market.

—-

Author : Victoria Jones

Publish date : 2025-03-04 02:48:24

Copyright for syndicated content belongs to the linked Source.